tax sheltered annuity taxation

A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts. Employees save for retirement.

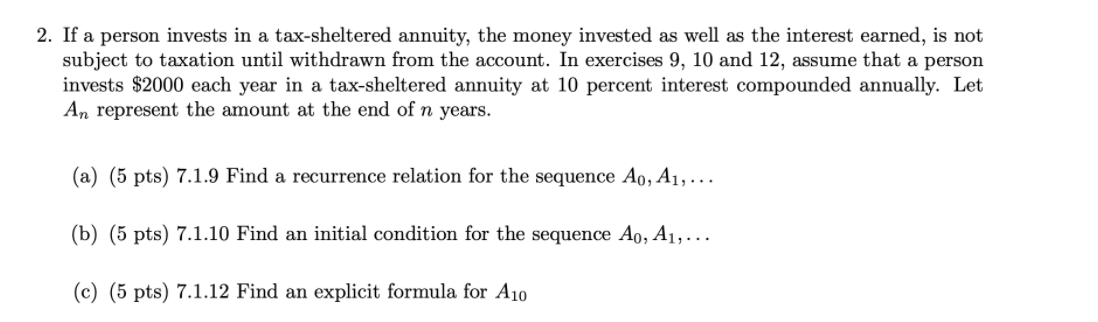

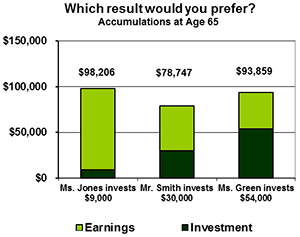

Solved 2 If A Person Invests In A Tax Sheltered Annuity Chegg Com

However the downside of doing so is that for an annuity held outside an IRA the entire amount of the appreciation between.

. New Look At Your Financial Strategy. The employee will not pay any taxes on their. Ad Compare income annuity quotes from across the market quickly and for free.

Find a Dedicated Financial Advisor Now. Income Annuity Quotes From Top-Rated Insurers. A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits.

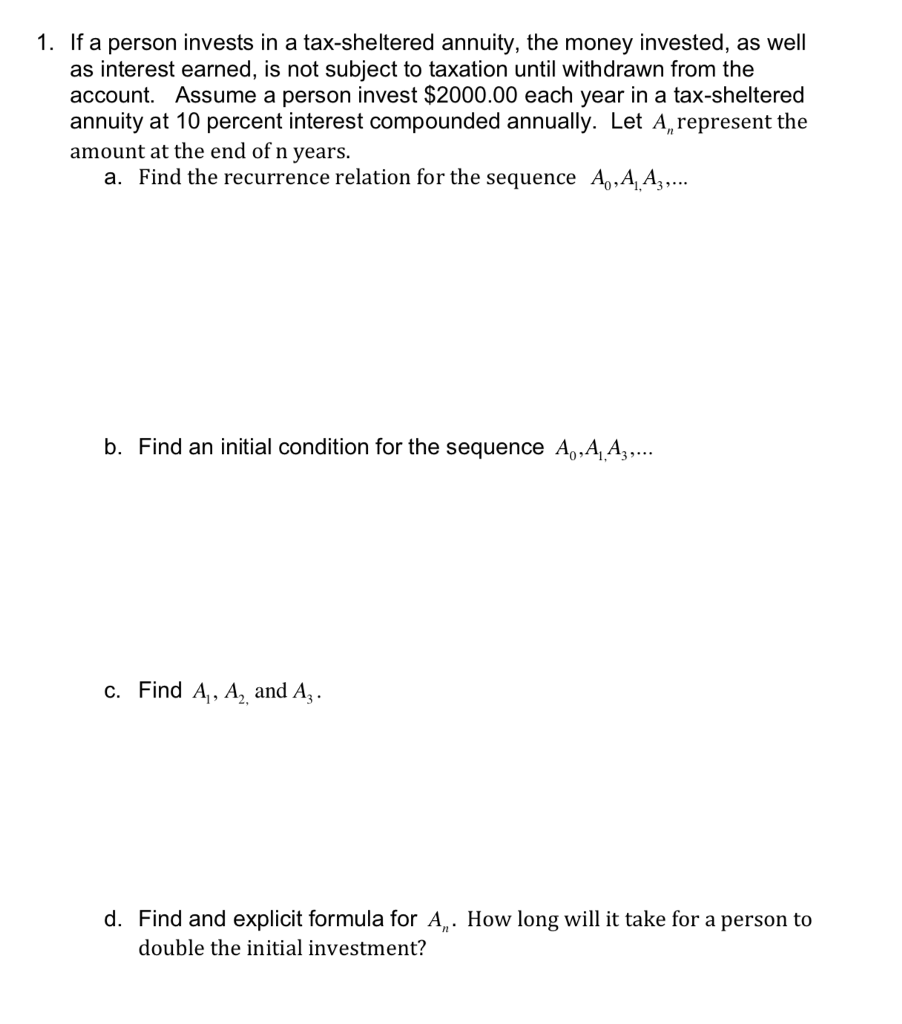

A non-qualified annuity is you purchased with money you have already paid taxes on. Annuities are taxed at the time of withdrawal regardless of the. The simplest is to elect an immediate lump sum.

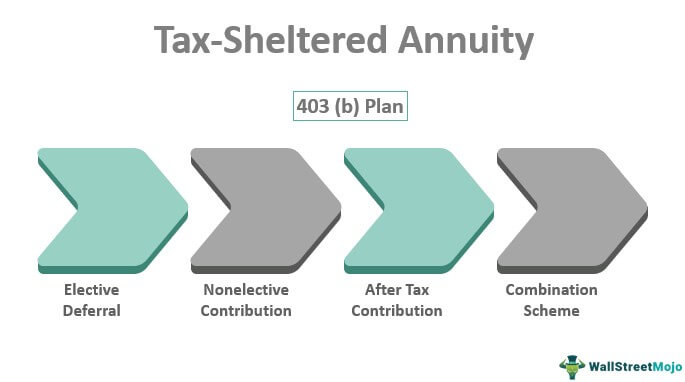

That kind of sounds like a Roth account but theres a catch. The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt.

Do Your Investments Align with Your Goals. The contributions made to a non-qualified annuity arent taxable. Withdrawals from variable annuities may be subject to ordinary income tax a 10 IRS penalty if taken before age 59 ½ and contractual withdrawal charges.

Learn some startling facts. So if the annuity buyer paid 10000. Contributions to a TSA are taken from your earnings and set aside in the retirement plan to.

Of course this is assuming you have a pre-tax annuity. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. Guaranteed income starting immediately.

As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the specified tax. Ad Annuities are often complex retirement investment products. However any growth or earnings on your initial.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal. A tax-sheltered annuity is an investment that facilitates employees ability to contribute before-tax income into a retirement account. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

TSAs are often offered to employees. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying An Income Annuity. The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. So if you wrote a check from your taxable bank or brokerage account to pay the premium.

As mentioned Tax Sheltered Annuities or TSA is a savings program that allows employees or individuals to make contributions from their pre-tax income and put into a retirement plan. Tax-sheltered annuities TSA are considered to be a qualified retirement plan. Visit The Official Edward Jones Site.

Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity.

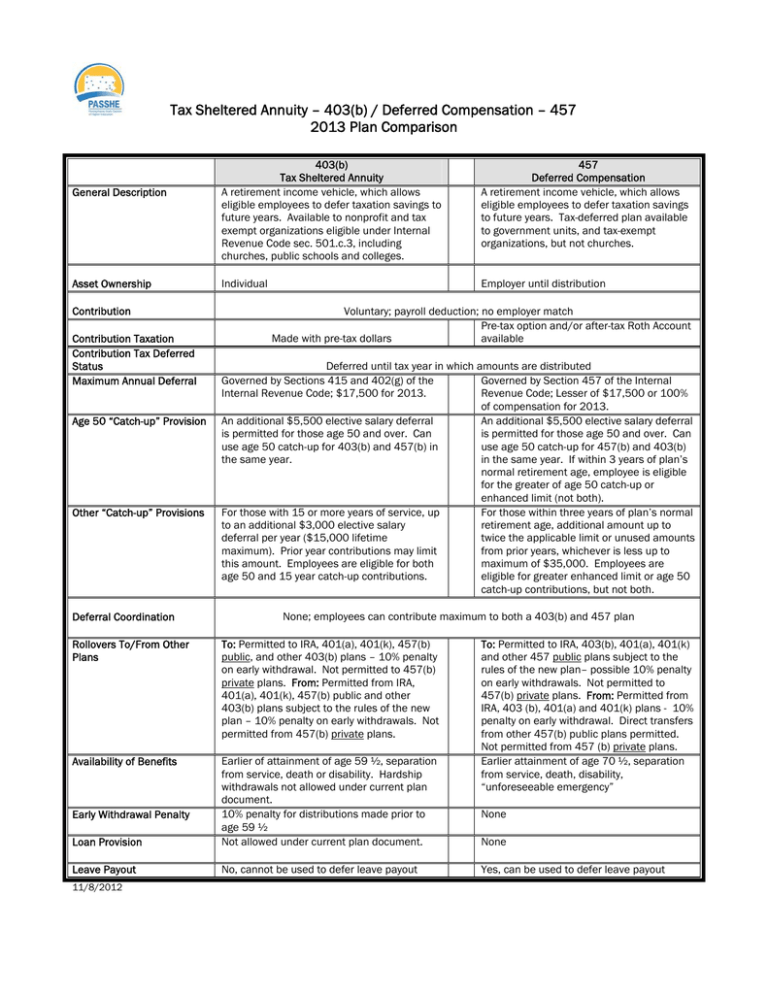

Tax Sheltered Annuity 403 B Deferred Compensation 457

What S The Difference Between Qualified And Non Qualified Annuities

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Lifetime Income Later Safety Guarantees Magi

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Withdrawing Money From An Annuity How To Avoid Penalties

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Annuity Taxation How Various Annuities Are Taxed

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Are Annuities Taxed

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What Is A Tax Deferred Annuity Due

Withdrawing Money From An Annuity How To Avoid Penalties

The Tax Sheltered Annuity Tsa 403 B Plan

403b Tsa Annuity For Public Employees National Educational Services